NFTs, Digital Leverage, Gaming and the Long Tail of Crypto Adoption

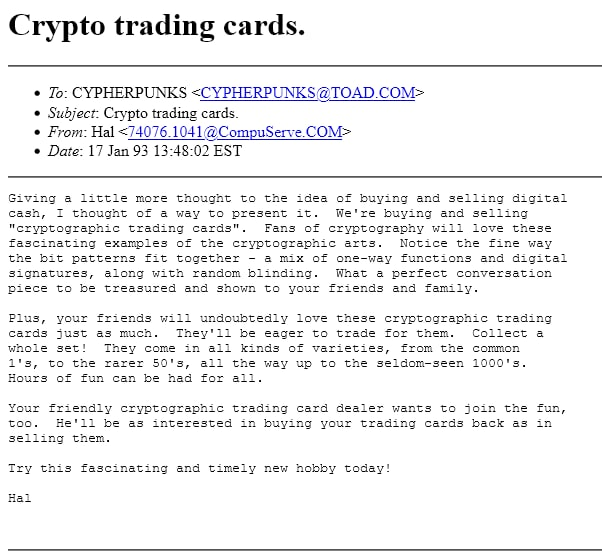

The catalyst behind broad crypto adoption has been speculated on since before the first genesis block of any chain was mined. One of the first examples of this was Hal Finney, a BTC and crypto pioneer, in an email sent in 1993. Hal wrote, "We're buying and selling 'cryptographic trading cards'. Fans of cryptography will love these fascinating examples of the cryptographic arts. Notice the fine way the bit patterns fit together - a mix of one-way functions and digital signatures, along with random blinding. What a perfect conversation piece to be treasured and show to your friends and family...They come in all kinds of varieties, from the common 1's, to the rarer 50's, all the way up to the seldom-seen 1000's. " With the obvious benefit of hindsight, we can map this concept directly to the explosive growth of NFTs (non-fungible tokens) today. Fittingly, I think NFTs will usher in widespread crypto adoption. While NFTs could be distilled down to a single sentence (NFTs are interoperable, programmable, verifiable representations of digital items), the practicality and implementation this enables leaves infinite possibilities. The two core NFT use cases I think will lead to massive secular growth are digital leverage and gaming.

Digital Leverage

Over the past several years (drastically increased by COVID-19), being digitally native has become an expectation. Everything and everyone from companies and brands of all sizes, to any form of organization, to individuals are consistently improving and monetizing their digital presence. What this has enabled is the realization and experimentation with digital leverage; recently dramatically enhanced by NFTs. Digital leverage can be summarized with an excerpt from an excellent post by John Palmer where he says, "for entire broad categories of software, if an application doesn't recognize that people hold inventories, it won't be compelling to users. As we move into the future, more people on the Internet will be accumulating their own inventories of digital objects and won't want to spend time in software that forces them to 'start over'". NFTs, and crypto broadly, are drastically expanding the interoperable nature of these "inventories" that we're just beginning to explore.

Ownership and scalability are the two core components of digital leverage. Inventories and ownership can be used interchangeably in the new digital realm, as NFTs give people, users, gamers, companies etc. the ability to own the assets they interact with. Composability is the attribute that ties ownership and inventories together as the ability to port and move digital items across various different domains is a unique trait NFTs and crypto enable.

Companies, games, ecosystems, social networks and everything built on top of, or interacting with, web 3.0 not applying this interoperability concept will fall behind. We'll continue to see these "inventories" increase, which creates demand for composability of digital assets increases, which creates new, broader inventories feeding a massive flywheel effect supported game theory.

Power of true ownership and the ability to profit off of

- Inability to transfer digital items and in-game assets, game ecosystem TAM and users becomes increasingly difficult to grow as no one will want to operate inside a closed environment (already seeing this with API access, open source code, etc.)

- Inability to transport followers/likes/accomplishments etc., ecosystem won't benefit from network effects already established along with the inability to integrate with future web 3.0 social media and community based things

- Inability to compose with established games and organizations and not allowing users to build on top of your ecosystem drastically limits the upside potential moving forward

Digital presence/ownership worth more than physical at scale and ability to leverage marginal cost increase in producing more goods (think software at scale)

MARGINAL INCREASE OF USERS --> through future scaling of social networks, internet access, online presence would prefer digital items/experiences as they have orders of magnitude greater reach than physical items, especially things that could easily seamlessly integrate links to wallets that the lay person can understand kind of like a flex of friends/likes/retweets/favorites/etc --> those are easy to display now but future will be easy to have a representation of NFT (digital assets) at similar ease of use

VIRALITY OF THINGS--> Beeple, baby yoda (specific IP), Visa cryptopunk, etc etc, viral growth lasts and is much more tangible to future value and indicators than real life things at the same scale --> impressions and views are worth more

SCALABILITY through traditional internet distribution models and reach that NFTs and digital assets have. The world is increasingly active 24/7 with global distribution that crypto uniquely benefits from as the markets are global and never close.

Crypto protocol TVL/Employee ratio --> digital leverage here as well tens of millions to hundreds of millions of value per employee --> Banteg tweet of Curve 13.5B / 6 = 2.26B per employee

A good example of the new shift is the recent crypto punk purchase that Visa made. Think of press coverage of Visa buying an NFT as another form of digital leverage. The scale and distribution that entailed isn't possible in the physical/non-crypto world. Operate on a global, 24/7 level where people would rather flex a profile picture worth 500k than buy a new house partly because one's addressable market is n of family and friends and the other is n of the user base of platforms where it is displayed. Digital Leverage creates unparalleled operating scale where digital items ~should~ be worth more than physical items because of their networks and drastically reduced marginal cost to add n items or assets.

Scalability in distribution and audience along with utility as the programmable nature of digital items allows them orders of magnitude more flexibility and composability.

Recently seen the value in digital presence and marketing after witnessing digital business models become more valuable than physical stores. Digital goods operate in the same comparison where the TAM is infinitely more vast than the physical world due to obvious constraints that don't apply online.

Digital leverage also creates access, community, and identity. We're already seeing the beginning of what leveraging a NFT (in this case as a profile picture can enable). Whether it's cryptopunks, BAYC (Bored Ape yacht Club), or some other PfP (Profile Picture), you are immediately welcomed into that specific community and sometimes even granted access to Discord servers, community get togethers, etc. This trend is not new and has existed as long as humans have. Whether it's religion, profile pictures, sports fandom, niche interests, politics, country flags, etc. there is a community you belong to. This is exacerbated in the Web 3.0 and NFT realm through the combination of skin in the game and true ownership. Buying an NFT to participate in a community has real economic costs compared to putting a hashtag or flag emoji in your bio, but with that come the benefits of Discord, Telegram groups, and even exclusively communities where ownership levels of certain digital assets are required for access. NFTs and PfPs create digital leverage in the fact that you can access these communities and participate in the economic growth and expansion of said community along with the other members.

Loot as the ability to have NFTs represent immeasurable and open design space of charafcteristics that could be applied/used inside a game without that specific game even existing as the community of NFT holders/participants works together to build it out

DIGITAL LEVERAGE IN MEMETIC DESIRE AS THEY global, connected reach creates a feedback loop of increasing desire to be a part of a community as each marginal user has potentially thousands to hundreds of thousands of interactions as PfP avatars

Finish with Axie example of scaling their revenue and leading into further discussion of NFT games and their models, expansion and trading/ownership of NFTs

network effects and scalable nature without proportional costs to scale perfectly exemplified by Axie growing from revenue of 100,000, to 350M, to 700M in ~6 months

END WITH NETWORK EFFECTS & GAME THEORY

game theory -- first operational, global game that benefits ~50ish million users will have such strong network effects and user demand for portability of assets that every game thereafter will have to incorporate interoperability between games and their in-game assets as NFTs because the users will demand it or someone else will fill the gaps where they resist -> user/gamer demands always win out

Gaming & the M Word

The single largest community in the world is that of gamers. According to Statista data, there were 2.69 billion active video gamers worldwide in 2020 with that total estimated to grow to 3.07 billion by 2025. More Statista data shows that in-game purchases reached a staggering $54 billion dollars in 2020. Gaming, along with internet growth and penetration, are two of the highest growth sectors not only of the past 10+ years, but expected future growth as well. There's only one industry that has grown at a faster pace and that is the home of NFTs, the crypto economy. Things become extremely interesting when combining crypto backed economic systems and games. The M word (Metaverse) has been unavoidable recently in part due to the design space and imagination possible when combining ownership and economic systems built around and through the interconnection of games. Ownership of in-game assets and the ability to frictionlessly transfer them (again, refer to inventories and network effects referenced above) from one online, interactive space to another.

THINGS TO WATCH IN THIS SPACE

-

everyone knows Axie (ETH)

- recent Colossus episode --> Axie revenue JAN (100k), JULY (196 million!!!), AUGUST (370 million !!!) -- network effects, scalability, escape velocity, any cliche here is unmatched in that level of growth that reinforces how rare the network effects and scalability are that crypto/blockchains enable --> marginal cost to software/company are nothing for every additional 100M in revenue, TVL, growth, etc

- INSERT 30D v. 90D retention numbers tweeted recently here --> in fucking sane

- Star Atlas (Solana)

- Aurory (Solana)

- DeFi Land (Solana)

- Immutable X (ETH, launch partner)

- Ninja (Solana)

- DFK (DeFi Kingdom, Harmony One)

List the market and numbers, connect to Axie Infinity and other blockchain/crypto games (Star Atlas) and how blockchains, NFTs, tokens will completely transform the future of gaming as people can earn, or not lose! money while having actual ownership and composability between items in separate gaming worlds

Play to earn and Axie Infinity {few links including mine}, again Axie reinforced the incentive alignment that players and developers have to ensure the game is operating as well as possible and growing the entire ecosystem

SCALABILITY also at the protocol growth level enabled by the open, composable nature of NFTs allowing users, developers, protocol engineers, etc to make improvements as they collectively own and operate the ecosystem and are incentivized/rewarded for it's growth

The perfect example of previously discussed topics including digital leverage, network effects, ownership, play-to-earn, scalability, and economic incentives is tied together perfectly by Axie Infinity.

Digital Leverage and scalability also massively benefit blockchain games as they scale and grow. Axie REVENUE, JAN--$100,000, july--196 million, August--370 million

two-way economies inside games where players can benefit, contribute, and grow the total value of the game economy compared to the previous walled gardens and one-way value transfers (users pay for game items with no ownership) of previous games --> "BI-DIRECTIONAL VALUE FLOW" rare things exist with incentive alignment where value flow increases to the users as the ecosystem grows (NFTs representing digital assets creating economies that can allow selling, developing, lending, borrowing, of said digital assets) and creators, DAOs, whoever governing the game ecosystem benefiting from the growth in some form of fee share.

As writing this, opened an email from Star Atlas (Solana blockchain game) with some development updates and announcements. One of these was a brand partnership between Star Atlas and Animoca Brands that read, "through this groundbreaking cross-platform collaboration, we will cross-license intellectual property, and further empower true digital ownership in making in-game items permanent assets in a self-sustainable player-owned economic system."

Other things NFTs enable

-

Crypto Enabled Attributes

- interoperable, composable, 24/7, permisionless, global coordination that is applicable to the entire crypto ecosystem including NFTs and fungible tokens

- incentive alignment--coordination and open contribution of protocols allows for beneficial growth to the entire ecosystem

- users, participants, developers, etc. all have the same economic benefit and ownership of the protocol, NFT, or token which inherently creates massive network effects on a global scale

-

Sports Collectibles & Ticketing

- NBA Topshot (soon every major sports league) -- ability to own your favorite player's best plays and a derivative speculation on the future improvement of specific players

- See rich history of sports cards/memorabilia -- next logical step is leveraging the ease of access, composability, and permanent ownership that crypto enables

- Beginning to see the earliest experimentation of event ticketing NFTs corresponding to traditional ticketing with the added benefit of building in more utility, rewards, interoperability that NFTs enable

-

Fractionalization & Liquidity

- fractional.art

- ability to mint NFTs representing real world items or not, and then fractionalize their ownership into fungible tokens that can be used as collateral, to lend and borrow, increase liquidity and access

- Already happening with high value NFTs such as cryptopunks but also easy to imagine a future where this applies to real-estate, home-ownership, cars, high-value tangible assets (wine, irl art, rare items, etc.)

-

Verifiable Representation of Accomplishments

- earliest experimentation developing here as on-chain protocol involvement, tasks, accomplishments, etc. could be represented as verifiable NFTs

- Unique representations of ~anything~ digital, or representing real-world

-

Ownership and participation in Web 3.0

- NFTs as the core economic element of the next-generation digital economy

- Allow ownership and financial benefit from social capital at a global scale that represents the vast and exponentially increasing of online interactions/items we consume

- Ability to transfer, value, lend/borrow, collateralize, represent ownership the entire world of digital assets and things

So, what next?

Ultimately, the bull case for NFTs and crypto adoption continually reverts back to some of the core crypto enabled concepts applicable to both NFTs and fungible tokens. Globally accessible, digital assets that are interoperable, permisionless, and composable have unlimited design space and hyperspeed feedback loops that allow more flexibility, interoperability, lower marginal costs, and lower barriers to entry that are accessible to everyone with an internet connection.

Applicable to current markets--> SOL/ETH, SOL as the gaming and low value, high throughput settlement layer while ETH settles mid-high value transfers and certain DeFi protocols. Symbiotic relationship between the two moving forward?

Post will be finalized EOM November