Axie, Helium, and The Future of Disruption

11/6/21 UPDATES & GROWTH

$AXS price --> original post 6/30/21 $AXS = $5.75 --> now, $AXS = $163.50

#HNT price --> original post 6/30/21 $HNT = $12.69 --> now, $HNT = $38.08

Some metrics regarding the wild growth of both Axie and Helium since original post was made

- DappRadar Q3 report - "According to Sky Mavis (Axie game developer), Axie has surpassed 1.5 million active users during Q3. In addition, this quarter (!!!), the game generated over $776 million in revenues(!!!!)."

- Axie's ability to retain users it's absolutely wild over a 30/90d period which can be seen and analyzed by the amazing Amy Wu here.

- Helium expands to offer 5G connectivity through their hotspots. A few quotes from the Decrypt Media post surrounding the announcement.

- "Dish customers can deploy a 5G node to share connectivity and earn crypto token rewards via Helium's network." --> We're at the earliest stage of seeing what network building can look like through token distribution while subsidizing hardware costs to the users as they are rewarded for providing the service.

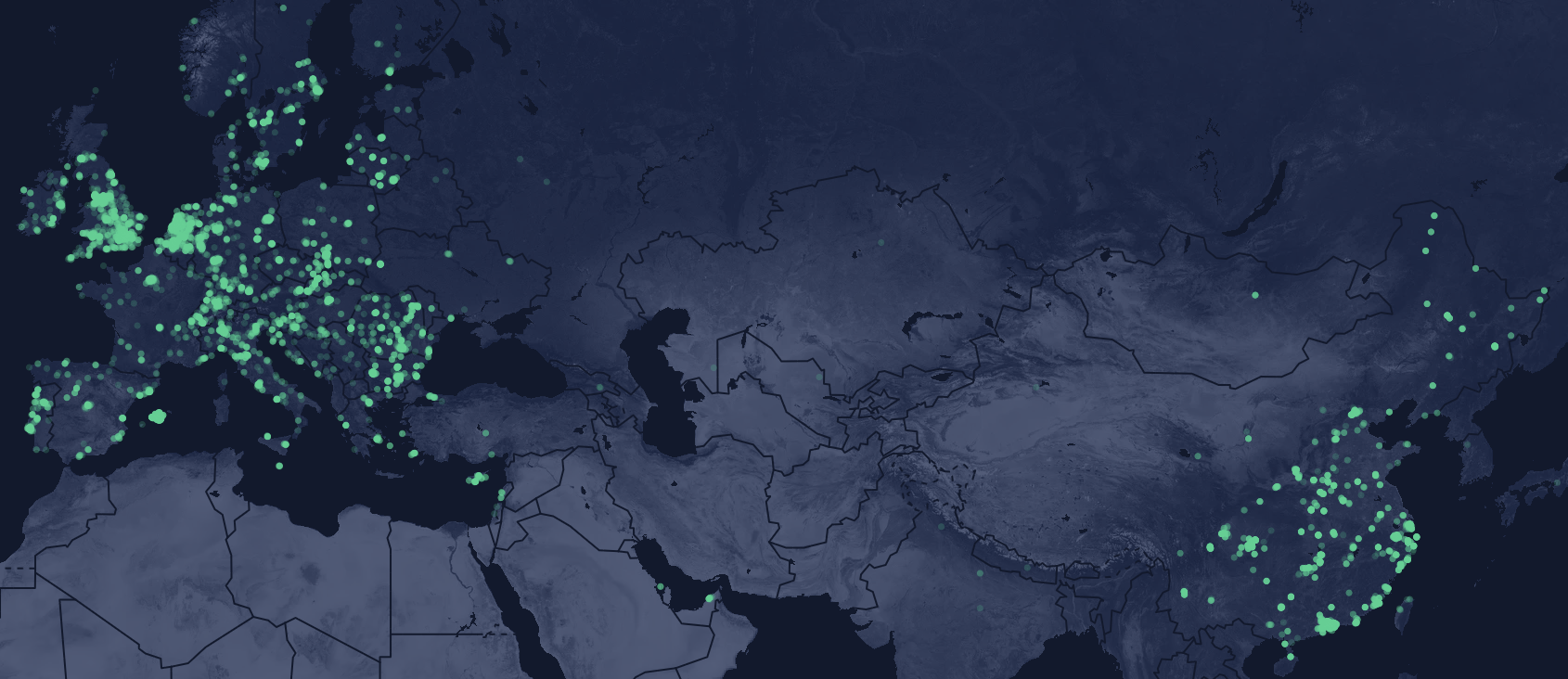

- "Crypto startup Helium showed that user-run wireless network can be bootstrapped with token rewards, with its original Internet of Things (IoT) network now boasting more than a quarter of a million active nodes. Now it aims to do the same with 5G connectivity."

- "...this partnership is a real validation that the HNT incentive model is a powerful tool for deploying infrastructure at scale." --> As stated above, token incentives and what they can enable at scale for the distribution of a ~real-world~ network are mind-blowing.

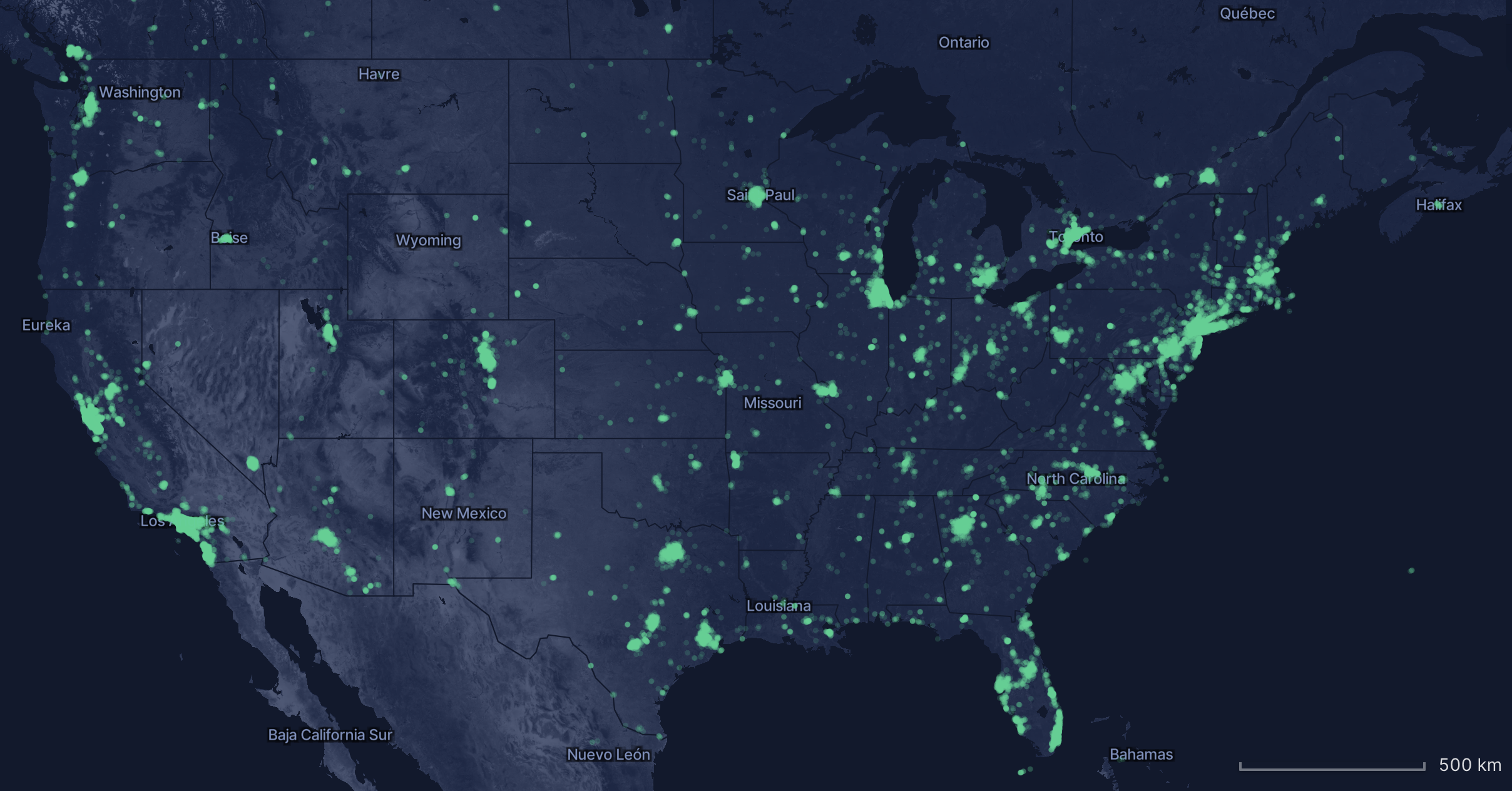

- CEO of Helium Amir Haleem commenting on the Dish partnership announcement saying, "Helium represents a fundamentally new blockchain-based approach with a radically reduced cost structure to deploying and managing a wireless network at scale. With over 256,000 Hotspots now live across 22,431 cities and 144 countries."

There are two common diatribes that slowly seem to be interconnected. They've both been around for about the same time, and are facing an increasing amount of regulatory scrutiny but they couldn't be farther apart in their respective ethos and goals. Of course, I'm talking about Big Tech and Crypto. While the attacks on each have grown over the past few years, it seems as if they are becoming lumped together in a giant zero-sum game against the environment and the end consumer. By the end of reading, I hope to present a compelling case that not only can crypto return power and choice to the consumer, but it can do so while rewarding them and letting them be active participants in the seemingly only networks that can disrupt Big Tech.

The two main crypto assets (along with brief examples of potential disruptors) we'll be exploring that provide the optionality of choice to participate, rewards for participating, and share in economic upside are Helium and Axie Infinity. While Axie clearly falls into the gaming category, both of these networks fall more broadly into a sub-sector of the crypto industry that I think will simultaneously disrupt and create a synergistic relationship with tech, Web 3.0. Mason Nystrom of Messari, wrote one of the best descriptions of Web3 saying, "Web3 manifests through new technologies, such as cryptocurrencies, virtual and augmented reality, AI, and more. Empowered by new technologies, the Web3 movement is spearheaded by a shift in how we, the collective, view and value the Internet. Web3 is about creating an Internet that works for the people, owned by the people.

Helium, The People's Network

Directly from Helium's official site, they say, "By deploying a simple device on your home or office, you can provide your city with miles of low-power network coverage for billions of devices and earn a new cryptocurrency, HNT." Helium refers to itself as The People's Network because the core idea is placing a small, router like device inside your home/office (although they've expanded to more complex and wider ranging outdoor products as well) that takes a non-performance effecting amount of bandwidth from your internet provider and repurposes it for IoT (internet of things) LoRa capabilities. This LoRa is provided to IoT companies (think smart devices that don't require high bandwidth to transfer data) ranging from thermostats to scooters to smart sprinkler systems to parking meters to dog trackers, etc. for a price to the IoT provider. The data is paid for in Data Credits that can be purchased with HNT. The Helium hotspot distributes miner rewards for providing proof of coverage (similar but obviously different from proof of work BTC and proof of stake blockchains) and verifying the Helium Network that you can then sell for other crypto assets, convert to stablecoins (dollar pegged cryptocurrencies) and transfer to your bank, or simply hold the HNT for price appreciation (all of this is done automatically on your behalf while using 5w of energy, similar to a LED light bulb's energy output).

The entire crypto-economic structure is obviously more complicated and you can read their tokenomics for more if you'd like, but I think the general idea is clear. Syphon a trivial amount of bandwidth from your internet provider you wouldn't use to begin with, and get rewarded for providing coverage and helping to expand the network. This may seem a bit abstract and complex but in practice it's extremely simple. There are an endless amount of YouTube videos and documentation to help you set your hotspot up, but it's a few simple steps that essentially boils down to plugging a router into an outlet. Upkeep and the complexity of the system is managed entirely inside the hotspot as the official Helium mining documentation states, "Once your Hotspot is completely deployed and fully synced with the Helium blockchain, you as the owner are not required to do anything else in order to earn HNT. Your Hotspot will perform all of the above activities while it runs."

Amazon & Big Tech

A few weeks ago Amazon received a negative press onslaught for releasing a product they call Amazon Sidewalk.

Here is how Amazon describes Sidewalk from there official site, "Amazon Sidewalk creates a low-bandwidth network with the help of Sidewalk Bridge devices including select Echo and Ring devices. These Bridge devices share a small portion of your internet bandwidth which is pooled together to provide these services to you and your neighbors. And when more neighbors participate, the network becomes even stronger." Huh, sounds familiar. Now, these two services are not in direct competition but even if that was the case, the competition is not what matters here. What is far more important, in my opinion, is the difference in incentives, data privacy, choice, and economic value provided to the consumer for similar services.

As you saw, and can Google for yourself, there was massive backlash to this announcement for a few key reasons. First, Amazon chose to retroactively apply this upgrade to all existing Echo/Ring devices and make the terms opt-out. If you were not aware of this upgrade, it just kind of went live and you may never have any idea that it's happening. Obviously, in today's tech landscape creating anything that is inherently opt-out is a bold decision that is asking for regulatory scrutiny. Second, there's marginal additional benefit to the Ring/Echo users. Again, it's just happening unless you opt-out, and even if you opt-in you aren't rewarded other than marginally increased performance for your Ring/Echo. This can also be summarized by a great Twitter thread from the CEO of Helium explaining the differences between the two networks and reinforcing that they're not direct competitors.

Compare the previous paragraph to what we know about Helium. Helium is opt-in (with an up front cost of $300-$500 for a hotspot) while Sidewalk is automatically enabled. Sidewalk participants don't see an increase in value while Amazon gets access to more data and farther reach. Helium hotspot owners are rewarded for coverage in the HNT token, currently trading at $12.09 per HNT (rewards vary on a number of factors). The future price of the HNT token is correlated with future network growth, further benefitting the end consumer while Sidewalk participants are largely not rewarded.

Helium also recently announced a partnership with FreedomFi which provides open source Private LTE or 5G networks from comparable router like devices that will soon incorporate HNT mining and rewards. What you're presented with when navigating to FreedomFI's website is, "Open 5G for everyone. Open Software. Commodity Hardware. Cloud-Native Architecture." The explosive growth of the Helium network and success with IoT companies, has allowed them the ability to expand and they have their roadmap now focused on 5G. It's certainly an ambitious goal, but it seems likely in the near future that we'll have self-supporting, open Internet access, and 5G capabilities while being rewarded for providing the service as a distributed consensus that is rapidly expanding and benefitting from network effects.

There are many arguments today, predominately from the mainstream, that cryptocurrencies are worthless, energy-burning piles of garbage that have no use cases. While there are certainly hundreds to thousands of crypto assets this applies to, there are also some providing new, emerging ways to benefit and empower consumers all while rewarding them as the network grows. In a sea of "what does crypto actually do", this use case and comparison seems so direct and simple. The mechanisms of the service in each instance(Helium & Amazon) require a bit of something you already have, while one rewards you and let's you participate in future growth, the other provides minimal value to the end consumer (not a one to one comparison of competing services but seems naive to think Amazon wouldn't rapidly expand and scale this service to IoT and 5G). A lot of crypto use cases can be extremely extract, but this use case is clear, direct, measurable (see local hotspot rewards in your area here) and empowers the end consumer all uniquely enabled by blockchain distributed tokens and crpyto-economic design. Next, we'll take a look at another crypto economic model benefiting users with potentially massive real-world consequences.

Axie Infinity, Play to Earn, & Reward Mechanisms

Another story that you might have seen or heard about in passing over the past couple of weeks centers around Axie Infinity. Axie is a blockchain based game that can be thought of similar to Pokemon. What's different from Pokemon is the ability to earn crypto while you play. Players have the ability to earn NFTs or crypto assets through battling, breeding, trading, and selling digital pets. From Lean Callon-Butler in an article titled, "For Filipinos, Axie Infinity is More Than a Crypto Game" (article here), "Axie Infinity is a leading game in the emerging play-to-earn movement, where players of blockchain games can earn yield in the form of tokens or other rewards. Those rewards can be used in-game, or they can be traded on an open market if the player chooses. The latter option represents an important shift in the gaming world because traditionally in-game assets were confined to the centralized protocol from where they came, unable to be moved off the platform." Here, "moved off the platform" is taking shape in providing income, greater than the Philippines minimum wage. Players who earn in the game, can convert their rewards into a stablecoin (pegged $1, likely Tether or USDC), and use that stablecoin to directly cover their cost of living, redistribute their earnings inside the economic system of the game to potentially enhance later rewards and level up their pets, or hold what they've earned inside the game hoping it continues adoption and appreciates in price.

CNBC has a good article and breakdown of how the game works saying that, "Axie Infinity uses NFTs for the rights to each pet that is purchased. To grow these pets or breed them, you purchase SLPs (small-love potions). You can then sell these pets or SLPs for cryptocurrency and swap into your respective currency." As mentioned above, and referenced from Filipino participants quoted in the article, this game is supporting families and providing opportunities to already marginalized communities severely impacted by COVID-19. This clearly presents another example of a uniquely blockchain enabled technology providing real-world economic value and shows the ability to design crypto-economic systems where participants are rewarded for participating and can benefit from global, borderless network effects. It shouldn't be surprising that an emerging market is quick to adopt the game as there have been endless stories and anecdotes of people in Latin America in Africa using crypto assets for what they uniquely enable, avoiding capital/authoritarian controls, the devaluation of currencies, and remittances. All of these are often cited from people in the emerging market economies and are oft ignored by the people in first-world countries pontificating about how crypto is useless to them while dismissing the paradigm shift that is the ability to trustlessly participate in global systems that allow the transfer of value (here's a tweet from the Axie official account saying they're on track to be the largest Discord in the world, largely driven by third-world countries and emerging markets.

This is evidenced farther by the closing quote of the CNBC article from a mother of three in the documentary you can check out here. She says, "What matters is having money so we can eat, avoid debts and get through every day. It [Axie Infinity] sustained our daily needs, paid our bills, and debts." "I was thankful to Axie because somehow it helped us." Axie, along with Helium, are examples of crypto-economic designs that allow the participants to be rewarded by and participate in the future economic value of a network as it scales, something that was not possible even a few years ago.

These systems, and the crypto industry as a whole, are still so nascent. What is clear though, is that there are new crypto-economic models that are beginning to take shape allowing participants to benefit from, and participate in, network effects at a global scale. The speed with which the crypto ecosystem moves is unmatched so the right design of a protocol can reach exit velocity sooner than anyone can predict. Again, this is all so new but I'm betting that we'll see an increasing amount of protocols and networks designed to incentive users by rewarding them now and in the future that allow the ability to compete with and disrupt Big Tech and legacy institutions as we know them today.

A few of the other things/categories that are on the spectrum of experimentation to early implementation in the Web3 ecosystem that will have massive future ramifications for Big Tech are:

Data Privacy and Rewards--Gather Protocol, ASK Permission Protocol, ZK-technology/proofs. Gather and ASK are novel forms of crypto-designed systems that reward users for their attention/data. While GTH takes a small portion of compute power (similar to Helium) and splits the rewards between the publisher and user potentially eliminating the disgusting format of online-advertising we know today (banners everywhere, pop ads/videos constantly, etc.). ASK takes a different approach of paying you in their token for watching, viewing, and releasing your data for more precise, better ads only when you choose to/ are willing to allow them. Data control and targeting on your terms while being rewarded for providing it.

ZK-proofs/technology(zero-knowledge) is where things reach extreme levels of complexity, even for crypto standards. Zero-knowledge technology is at the core of cryptography and basically says that I can prove that I have or own something without giving up any information about what that is. From the excellent Packy McCormick newsletter, Not Boring, "For example, I could prove that I know the password to an account without entering the password and risking its exposure..The technology has implications for personal privacy, crypto, business, and even nuclear disarmament." The personal privacy aspect is the most applicable concept to this topic as it's easy to connect the dots of protecting your data online while also being able to prove you/your data is correct. It's early, but there could be protection against every site needing to know my email, log-in, password, location, and scraping through my previous internet browsing to try and target me with ads I'm .001% more likely to buy while they make billions. This easily ties back into the ASK Permission protocol where you can selectively sell your data and receive rewards for it to the companies that want to purchase it instead of them automatically scraping it.

Decentralized Storage & Computing--Akash, Filecoin, Arweave and others attempting to provide a better data management storage and cloud providing services to compete with Amazon Web Services and Google Cloud. Tokens that incentivize developer and customer use while that use increases the underlying asset and supports the network.

DAOs(Decentralized Autonomous Organizations)--people spread across the world who come together online to accomplish a goal, form an entity/organization, or buy something where the sole means of economic transfer is made through smart contracts on Ethereum. Code that is written that easily divides, sends, receives economic value for some purpose where the rewards or flows are strictly and effortlessly determined by the code written into the smart contract.

Decentralized/Portable Social Media--Mirror & other ongoing experimentations. Extremely early here but easy to imagine micro-payments for social interaction online with the ability to port existing followers/subscribes across platforms instead of the siloed approach today.

Disruption & Competition

While the focus of crypto assets is often the amount of energy they use, (and this is true for PoW blockchains although often misunderstood) there are use cases being built out in real time that provide immense benefit to the consumer, all while rewarding them with economic value and participation in the network. I think we're beginning to see the actual expansion and implementation of Web3 ideas that can compete with Big Tech on a global scale as they can provide economic incentives to participates uniquely enabled by blockchain based tokens. These protocols and their users/holders are benefitting from network effects at a global, distributed scale we haven't seen since Twitter and Facebook, all while being rewarded for every marginal increase in user adoption. Extreme best of both worlds.

Again, these ideas and protocols aren't even half a decade old and we're seeing Helium potentially disrupt and compete with conglomerates in the telecom space by providing IoT and soon 5G coverage while Axie Infinity, a blockchain play-to-earn game can provide increased wage pressure in the Philippines. Several of the other protocols/ideas listed above are also gaining traction and provide the unique optionality of choice to participate, rewards for participating, and share in economic upside along with potential, more-inclusive alternatives to the big tech giants. It's easy to see where this disruption and competition is leading to, how and who will get us there is the difficult part. The future is so bright.