Midterm to Longterm: Gaming + DeFi = Supercycle

-Exploration of gaming feeding DeFi as DeFi (dexes/lending protocols/NFT L&B protocols) is the backend that facilitates the transfer of the assets inside the games that reach exit velocity -- downstream effects captured of massive DAU (as games are good at capturing compared to protocols) exchanging game assets; leads to consistent growth and underlying sustained application/protocol growth

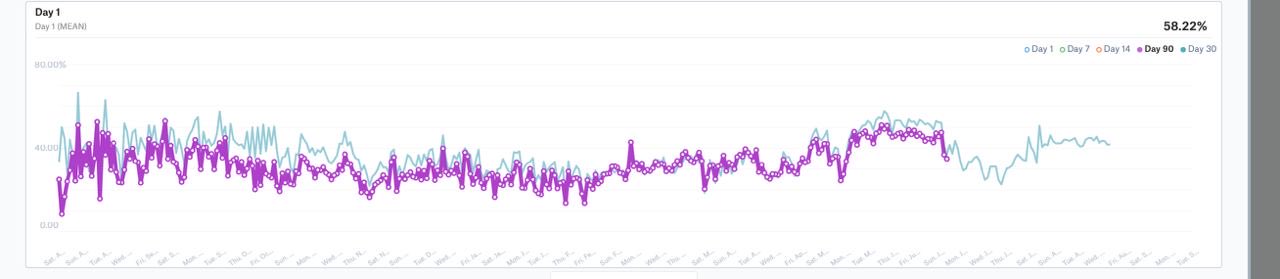

User retention is a metric that is meticulously tracked in every company, ranging from one person startup to fortune 500 company. Crypto is no different, especially in an industry that has merciless yield farmers and incentive programs released from every plausible corner. This chart, originally tweeted by Axie Co-Founder Jihoz, shows the overlap of 30 day and 90 day user retention numbers.

As pointed out in an excellent thread by Amy Wu, these user retention numbers (upwards of 50%+) are out of this world. As Amy points out in the above linked thread, the percent of users still playing Axie after 30 and 90 days resembles traditional employment retention metrics. There are numerous takeaways and potential down-stream effects that this enables, all leading to further crypto adoption and user stickiness that leads to sustained asset growth. Future implementation of crypto gaming at scale, along with core DeFi infrastructure supporting the exchange, lending, and borrowing of said in-game NFT assets and currencies can sustain massive growth and limit 50%+ drawdowns that we've seen in past market cycles.

DeFi + NFTs = Supercycle

Ability to have constant influx of users, capital velocity cycled through underlying DeFi protocols that facilitate the swap, lend, borrow, fractionalization of in-game NFTs reduces future drawdowns as there are more opportunities for yield, speculation, things to do for 10s of millions of users

Comparable Axie metrics where users and activity are still growing at insane rates, even through temporary days to weeks long drawbacks in broad markets

Hits all the Chris Dixon mental models including things as a toy, gamers leading the way, what people do @ nights and on weekends all integrated into one concept

Protocol Benefit & Future Games

ETH - Axie deriviate, Gods Unchained, Immutable X

worst positioned short to mid term, long term best with fee burn through EIP-1559 but user composability and application support for each game seems like a tall task --> everything out the window when there are composable, EVM ZKR (zero-knowledge rollups) but that with seamless integration across all DeFi applcications and bridge implementation between various rollups and liquidity all working properly in a post merge, post shard world for a seamless gaming experience on the backend seems years to half a decade away

SOL - Aurory, Star Atlas, Cryowar,

best suited in the short to mid term (potentially long-term if specific games take off) with high TPS and easy backend implementation with Serum and Raydium that can effortlessly implement LPs of various game currencies and facilitate NFT sales, accelerators, launchpads etc. basically all ready today --> Aurory and other developing games launching within a year already plan to use them on the backend for in-game NFT transfers

Harmony - DeFi Kingdom

-Playbook/User retention established with Axie and Ronin along with their building of DEX, clear demand and the need to facilitate the transactions and capture value is present

-ALT L1s' that don't have gaming with struggle to compete? As it becomes the key performance/user growth mechanism for the L1s? Explore this

Gaming --> DeFi --> Protocol Growth/reinvestment/more applications --> repeat cycle over and over and not only games are developed and feed into this feedback loop, but web3 dapps

-Largest cohort of users worldwide 3B+, Microsoft, EA Sports, UbiSoft all exploring/developing blockchain games while Epic Games is 'open' to the idea

-Game Theory of user retention/benefits of crypto-gaming and how everything will adapt (similar to web3 game theory of user's inventories as well), certain velocity hit, everything else has to function the same

SOL --> Aurory, Star Atlas (short, mid, long term), NINJA, CryoWars, MiniRoyale --> best functionality and liquidity flow right now, able to handle a developed game currently

ETH --> Illuvium, GMEE (Animica Brands all things) ImmutableX building supporting quickly --> liquidity/fragmentation of users/assets/rollups in the mid to longish term as all of that bridging and interoperability is solved --> ETH captures most protocol level value though through EIP-1559 with the eventual mass increases in block demand and transfers from games --> all changes and bets are off when ETH does finally have EVM compatible zkRollups

TikTok NFTs using Immutable X zkrollup technology

Harmony --> DeFi Kingdom

-Figure out user retention/growth during recent crypto drawdowns correlated with Axie --> i.e. was there a dip in users, growth, activity when crypto markets saw quick retraces --> admittedly a sample of 1, but unchartered territory here while the only evidence we do have is Axie growth is sticky, that of normal user retention of ~actual jobs~

Post finished EOM December